MB: Big Savings Potential at the City of Winnipeg

The City of Winnipeg’s salary and benefit costs have exploded over the past decade.

I’ve spoken about this issue several times over the years and Winnipeg Sun columnist Tom Brodbeck has crunched some good numbers on this topic as well.

But get a load of this number:

Had the City held salary and benefit costs for inflation and population growth over the past decade the city could be saving $121.3 million annually.

That’s enough money to more than double the city’s annual road repair budget.

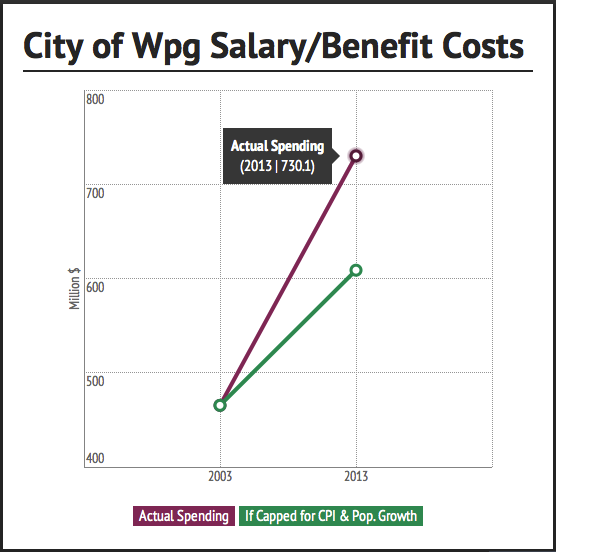

To see how I came to this number, crack open the city’s 2003 annual report and you’ll find the city employed 8,385 people and spent $465.4 million on salary and benefit costs. Open the 2013 annual report and you’ll find the city now employs a whopping 10,143 employees and spent $730.1 million on salary and benefit costs last year.

Over the same period, the City of Winnipeg notes the population of Winnipeg grew from 644,500 to 699,300.

In other words, this is what happened over the past decade:

Increase in population: 8.5%

Increase in bureaucracy size: 21.0%

Increase in salary and benefit costs: 56.9%

I contacted Statistics Canada to gather inflation information for Winnipeg over this period and they pointed me to Cansim table 326-0021. That led to this figure:

Increase in inflation in Winnipeg over past decade: 20.5%

How This Relates to the Mayoral Campaign

It’s great that Brian Bowman wants to try and save a total of $40 million over the next few years by looking at things like changing light bulbs. Gord Steveves wants to go after selling golf courses and use the savings (and incremental tax savings) to fix our roads (he calculates $100 million over the next several years).

Again, we’re glad they’re talking about savings and efficiencies…but both of those ideas are pocket change.

Do either have the stomach to go after a much larger problem – out of control salary and benefit costs? What about Judy Wasylycia-Leis, Paula Havixbeck and the other candidates?

Not much has been said so far by those wanting the big chair down at city hall about labour costs. When we put out our “Policy Menu” a few weeks ago (it’s a menu with 25 policy ideas for candidates to consider including in their platform), the major candidates were interviewed to get their take on the ideas.

Judy Wasylycia-Leis and Brian Bowman both commented on some of labour-related ideas and cautioned about ‘undermining existing labour contracts.’ But that wasn’t what we suggested. When labour contracts are up for negotiation, we want someone to take a hard line. Clearly the taxpayer is getting burned right now. (This blog post – click here – looks at taxation in Winnipeg)

If the candidate you’re leaning towards won’t even acknowledge skyrocketing labour costs as a problem then you should probably keep looking for another candidate to support. In the mean time, keep putting pressure on the men and women seeking the big chair to start talking about this problem.

In the City’s Defence

Here is where I will defend the city a bit on the explosion of some of these costs. In a way it’s partly out of the city’s control.

You see, when city hall tries to negotiate with the firefighers’ union, paramedics’ union or the police union it’s not a normal bargaining process – the unions can’t go on strike.

As a result, the two unions inevitably get increases that are around 3-4%; higher than what CUPE receives and what most taxpayers are getting. If the city doesn’t come to an agreement with the union, a provincial arbitrator is brought in and they inevitably come to a decision on an increase that is quite similar.

This problem is happening across the country and the unions use it to their advantage – using a gain in one jurisdiction to see a big gain in another. I often call the problem “public sector leapfrog.”

Consider what Maclean’s magazine noted about the problem in an April 15, 2013 article on government pay:

“A few years ago, Saskatoon’s firefighters were given an 18 per cent raise. They got the raise because Regina’s firefighters were making 12 per cent more. On that basis, an arbitrator awarded firefighters in nearby Moose Jaw a 17 per cent raise. By then, firefighters in Regina had become the provincial paupers. So last September, an arbitrator bumped up their pay by 14 per cent.”

So what can the City of Winnipeg do about this problem and overall labour costs?

Addressing Labour Costs

The first thing the city needs to do is talk about the aforementioned problem.

The city never talks about this problem in any meaningful way, but what we need is a change in provincial labour legislation. Arbitrators should be required by law to take into account what taxpayers and governments can afford, as well as inflation, when making their decisions.

Thus, if taxpayers are seeing an average pay increase of 2%, then that should be a guide for determining what police and firefighters receive.

Jim Wilson, a provincial politician in Ontario, proposed such a move a couple years ago when he tabled a private members bill in the Ontario Legislature. However, as you can see from this article, Wilson had municipal leaders standing with him.

What are our municipal leaders doing on this issue? Silence. Instead they’re just raising taxes and grumbling quietly.

Some will scoff and say the NDP here will never consider such a move so there’s no point. However, issues don’t get addressed until someone puts it on the radar. The city should start being more vocal and raise this matter with opposition parties.

But don't stop there. As this is a national problem, the city should be raising it at Federation of Canadian Municipalities (FCM) meetings - the organization that brings together municipal politicians from across the country. FCM should be doing more to talk about this challenge as well.

Again, requiring labour arbitrators to take ability to pay into consideration is hardly unreasonable – it’s not a call for layoffs or even wage cuts…it just asks for the taxpayer’s ability to pay be taken into account.

The third thing the city should do is look at its labour costs for other positions and make sure they’re inline with the private sector. For example, the city’s lifeguards have always made substantially more than lifeguards working in private facilities or non-profits like the YMCA.

The city should look at identifying areas where it’s paying too much and, at the very least, grandfather the old pay and benefit levels out. Thus, new employees would be paid an amount that is more acceptable to the taxpayer.

One thing is for certain, salary and benefit costs are a huge area for savings and a big reason why our taxes are going up higher than inflation and our roads are in the shape they’re in. Is your favourite mayoral candidate willing to talk about this problem? Or are they more inclined to just sweep it under the rug and discuss raising taxes?